Respondents were mostly millennials (aged 18-35) as well as adults aged 36 and up. The survey was served to visitors of the Rappler site from September 12 to 18. Majority (70%) of respondents hailed from the Philippines. There were slightly more female respondents (54%) than men (46%).

The survey's margin of sampling error is +/- 3 percentage points, with a 99% level of confidence. The poll sheds light on the new shopping habits of a modern, digitally-savvy market.

Procrastinating shoppers

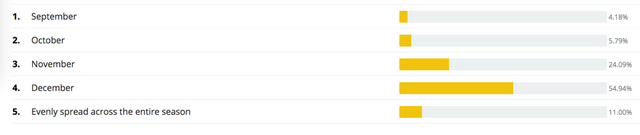

Though many retailers begin their Christmas campaigns in September, consumers aren’t making the bulk of their purchases that early.

Among respondents, 55% indicated that December is the heaviest shopping month, with November coming in second at 24%. Only 5% of respondents said they shop in either September or October.

This means that early marketing and in-store retailing efforts spent on Christmas may largely be wasted. The classic marketer’s dilemma of “Right Message, Right Person, Right Time” is likely missing the time target.

November and December would be the best months to launch a holiday-themed campaign. So much for avoiding the rush!

Cash is still king

Most Rappler readers might still be bringing around cash to shop for gifts. Among respondents, only 35% of respondents said they own a credit card, while 48% still do not own a debit card.

While this may seem comparatively low on a global scale (90% of Singaporeans already own and use debit cards, for example), this is still a significantly higher number compared to the national average of 7% for credit cards and 43% for debit cards.

This preference for cash also affects where they will choose to shop as well.

Most shopping will be done in-store

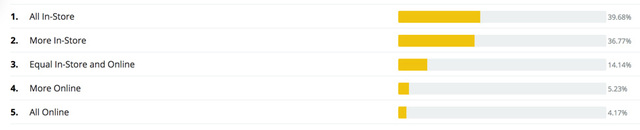

While e-commerce is rising in popularity in the Philippines, there is still a high preference for in-store buying.

When asked “How do you distribute your Christmas shopping between in-store and online?” majority responded they shop all in-store (39.68%) or more in-store (36.77%).

0 comments:

Post a Comment